Leading Growth & Inflation Signals

At Dorian Road Capital Management, we leverage market-based and macroeconomic indicators to identify inflection points in growth and inflation earlier than consensus economic reports like ISM and CPI.

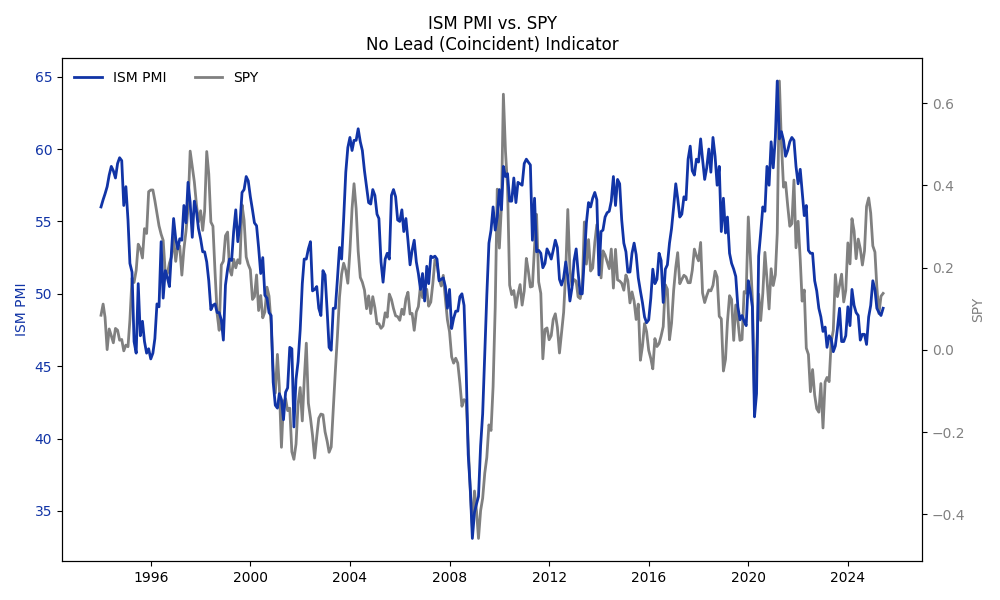

ISM and S&P 500 Relationship

While ISM manufacturing PMI reflects current economic conditions, it tends to move coincidentally with the S&P 500 (SPY), limiting its use as a leading signal. However, by observing sector leadership within equities, such as the consumer discretionary and staples sectors, we can anticipate future shifts in economic momentum.

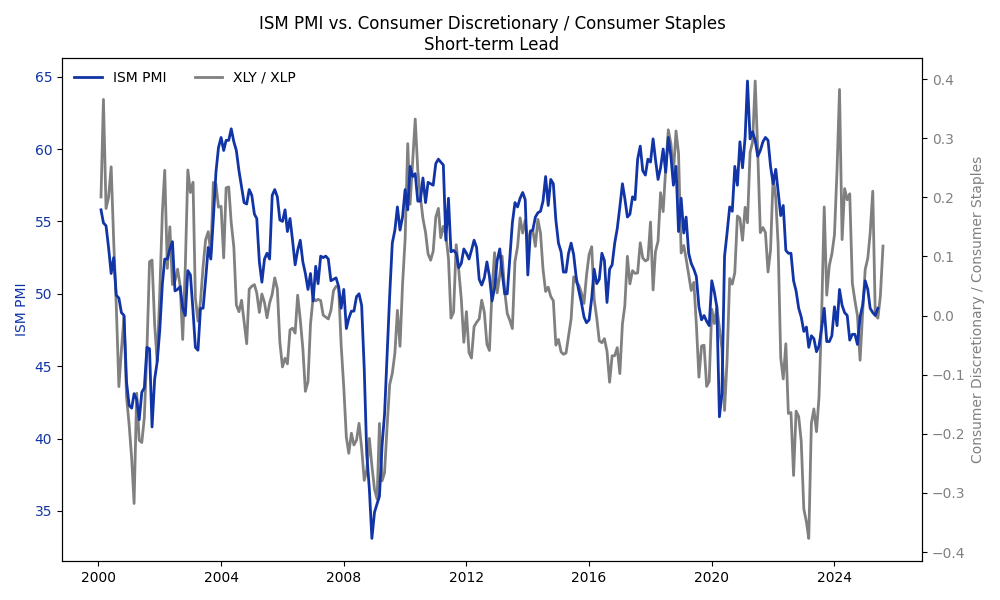

Consumer Discretionary / Consumer Staples

The relative performance of consumer discretionary stocks versus consumer staples stocks is a reliable early indicator of economic growth momentum. When discretionary stocks outperform staples, it signals rising consumer confidence and economic expansion ahead of official data.

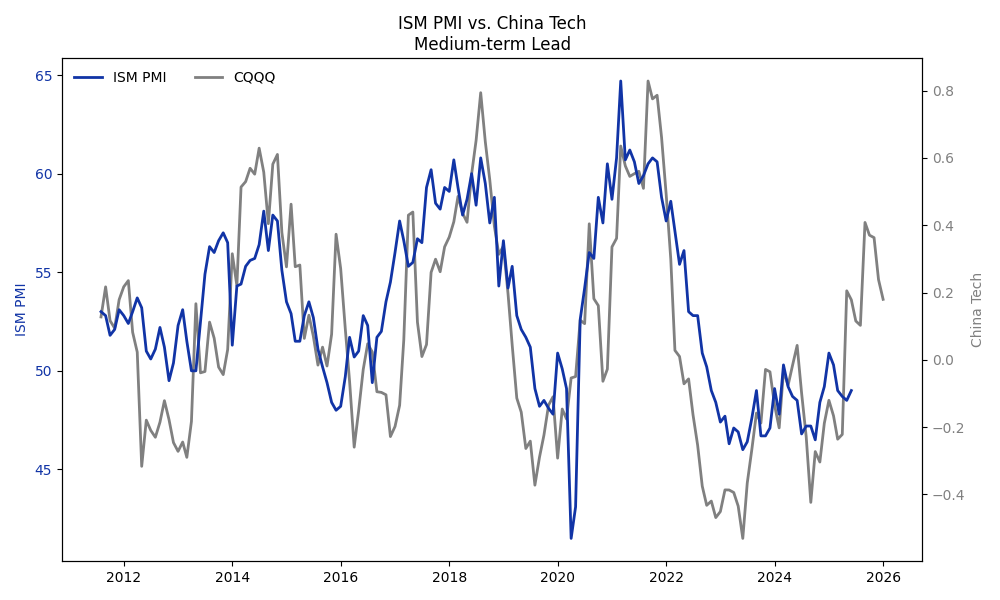

China Technology

China Technology reflects Chinese economic and credit momentum and often leads U.S. manufacturing cycles by several months. Monitoring its performance provides early insight into shifts in global industrial activity.

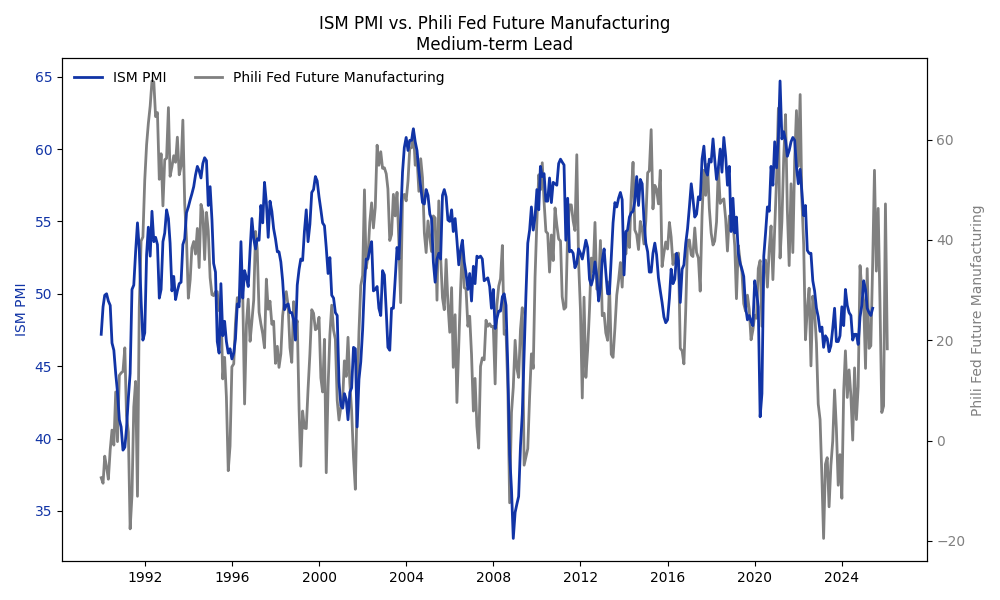

Philadelphia Fed Future Manufacturing Index

This forward-looking regional survey captures manufacturer expectations before they show in national economic data. Its movements are consistent and timely signals of shifts in U.S. manufacturing momentum.

Leading Indicators of CPI (Inflation Signals)

To anticipate inflation trends, we monitor key components and market-based indicators that often precede changes in the Consumer Price Index (CPI). These provide valuable lead time to adjust positioning for inflation regime shifts.

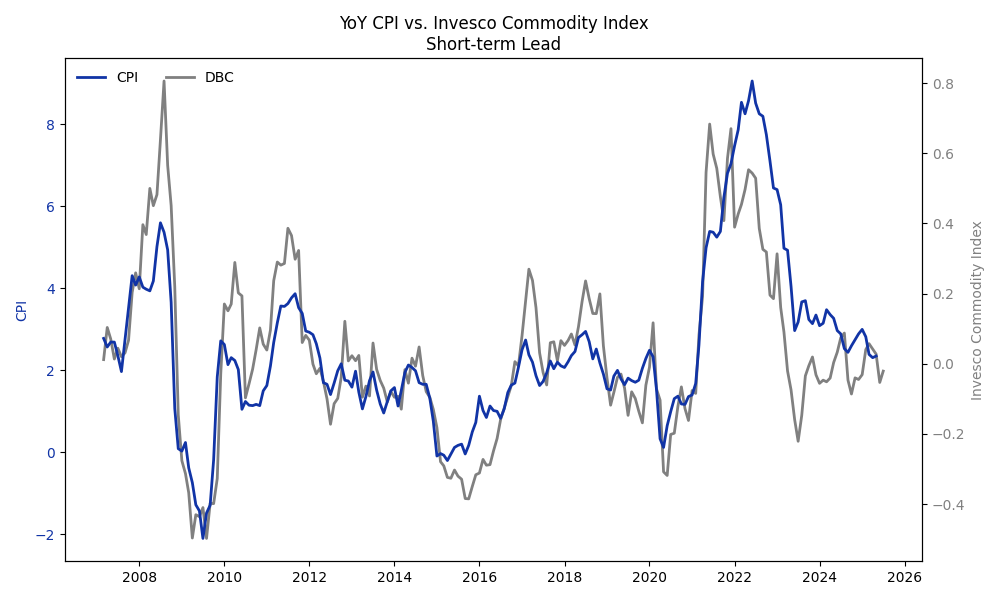

Broad Commodity Index

This index tracks a diversified basket of commodities, including energy, metals, and agriculture. Rising commodity prices often signal increasing input costs that filter through the production chain, typically leading consumer inflation.

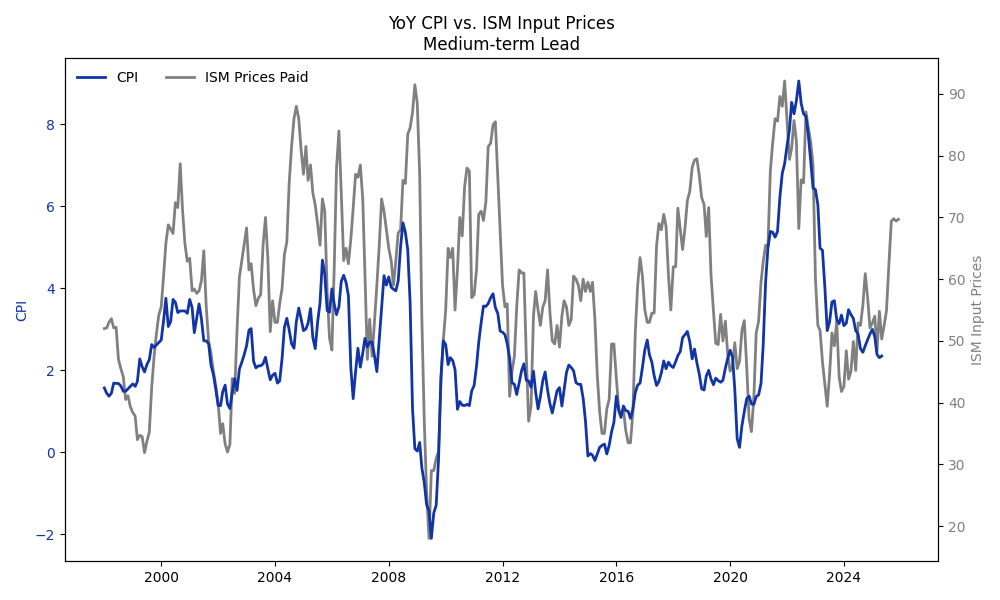

ISM Prices Paid Index

Part of the ISM manufacturing survey, this index measures changes in prices paid by manufacturers for raw materials and services. A reading above 50 signals rising input costs and inflationary pressures before they are fully seen in consumer price data.

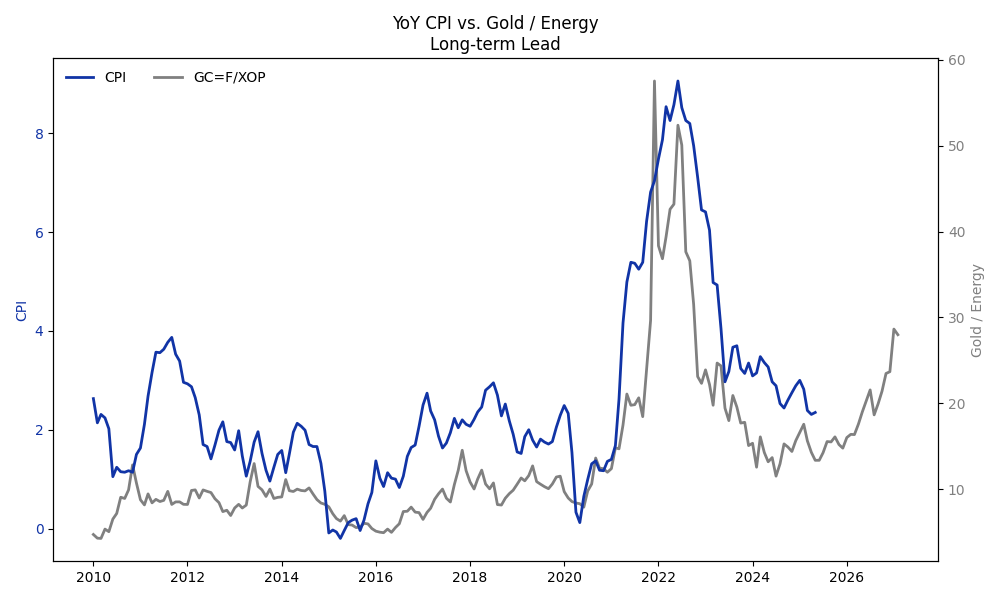

Gold / Energy

This ratio highlights relative inflation expectations and real asset value versus energy costs. Movements in this ratio can signal shifts in inflation dynamics, capturing monetary policy sentiment and commodity price pressures.

Why These Indicators Matter

Combining these diverse signals — sector leadership within equities, international momentum, and regional manufacturing expectations — allows us to anticipate growth regime shifts with greater confidence, improving our tactical asset allocation decisions.